Fed Will Be Forced to Lower Rates, End QT

Damaged banks, tight credit, frozen mortgage market will force their hand.

Summary: The headlines are dominated by geopolitical crises and human tragedy—Russia/Ukraine, Israel/Gaza, China/Taiwan—but investors are focused on the soaring 10 year Treasury yield. For reasons I lay out below, I’m sticking with my view that there will be no more rate increases this year and that the Fed will be forced to suspend bond sales and push rates sharply lower in 2024. This will create huge opportunities for patient, liquid investors to buy assets at fire sale prices next year. Be patient.

Main Points

This post is longer than I would like and I know that you have other demands on your time so I will begin with a brief summary of the main points:

Fed blunders, keeping rates too low, too long, then raising rates too high, too fast, and brought us to the brink of a credit crisis.

A major cause of their blunder was misreading flawed inflation reports. Correcting for imaginary Owners equivalent rent (OER), brings the headline Sept. CPI inflation rate down from 3.7% to just 1.96%, slightly below the Fed’s 2% target.

Even more sensible—scrap the CPI and PCE entirely, and switch to home price inflation, which was 2.1% in the 12 months ending in September.

Inflation is lower and real interest rates are higher than the Fed thinks they are. The Fed should end QT and reduce rates now.

In today’s opaque post-COVID world, with rising geopolitical conflict and a blundering Fed, stay humble, and hold too much cash. It’s better to be a buyer than a seller of deep-discount opportunities over the next two years.

Too High, Too Fast

The Fed has become the major source of instability in both bond and stock markets. The September FOMC meeting shows why. They left the funds rate unchanged, but said they would keep selling bonds, and unveiled an ugly dot-plot chart promising more rate increases this fall. In the days after the meeting, they gave us a string of orchestrated higher-for longer speeches that terrified investors and spiked bond yields. The 10-year Treasury rose above 5% and the 30 year mortgage rate broke 8%, a level at which nobody can afford to buy a house from anybody at today’s incomes and list prices. The speed of the bond market meltdown scared the Fed so much they flipped their Fedspeak script and started talking rates down again.

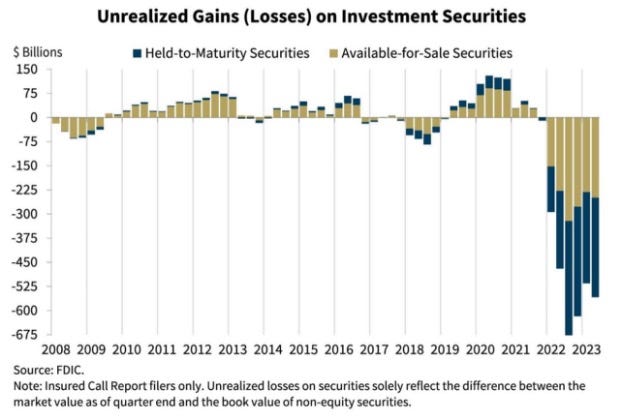

As I have written about here, here, here, and here, the Fed’s “transitory inflation” blunder made them keep interest rates too low, too long. Then misled by bad inflation data, they raised rates too high, too fast. As shown in the above chart, the damage to bank balance sheets (some $600 billion of losses so far with CRE losses yet to come), to residential real estate (collapsing home sales), and to credit markets (shrinking small businesses loans) is piling up. The irony is that inflation, properly measured, has been falling the whole time.

CPI Inflation Was 1.96% in September

September CPI inflation, corrected for the bogus “OER effect” (see below), came in under 2%. You can expect to see the same in the October report. As I have been writing for months, the sharp spike, then fade, of the CPI and PCE inflation data over the past year exposed a fatal flaw in the construction of both indexes—a nonsensical number that should be purged from the index, called Owners Equivalent Rent (OER) that carries the largest weight (25.6%) of any component in the market basket of goods used to construct the CPI.

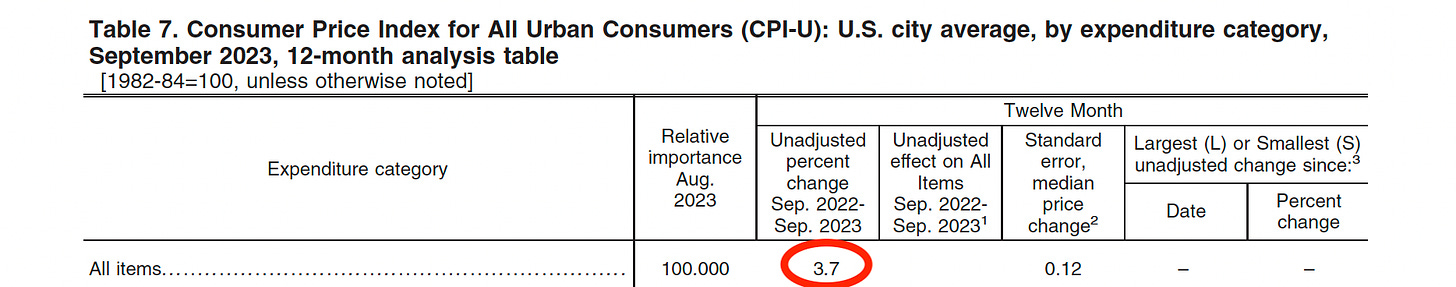

The above table, from the September CPI report, shows how OER distorts the CPI. The September All items headline inflation figure was 3.7% over the same month a year ago, less than half its peak of TK a year ago but still too high to be compatible with the Fed’s 2% inflation target. But the fictitious Owners Equivalent Rent (OER) component that makes up 25.6% of the index was responsible for almost half (1.74%) of the increase. If we exclude OER from the index, as I have argued we should do, the corrected September inflation rate was 3.70% - 1.74% = 1.96%, a hair below the Fed’s announced 2% target.

OER is an entirely manufactured number, a figment of some economist’s imagination. It is constructed by pretending that each of the 66% of American households that are homeowners rents its home from itself. (I’m not making this up.) The imaginary rent the homeowner pays to him/herself is viewed as a consumer expenditure and takes up a disproportionate share of the CPI index. The imaginary rent the homeowner receives from him/herself is added to both the personal income numbers and to GDP. (overstating all three numbers IMHO.)

The reasons given by the Fed and the BEA for including OER in official statistics are pretty shabby. One is that we do it to make our numbers more comparable to those of other countries with different (lower) home ownership rates, i.e., it is more convenient for the economists and data collectors. Another is so the numbers don’t change if a homeowner decides to rent out his/her house. But they make no sense for measuring inflation. One of the main reason I own my own house is because, by doing so, I have pre-purchased a lifetime of housing services at a fixed cost, i.e., I never have to worry about rent again.

Where do they get these imaginary numbers? They make them up from the (legitimate) rent data they collect from the 1/3 of households who actually do rent their apartments or condos from other people. This data, called “Rent of primary residence” in the table above, which accounts for just 7.6% of the checks consumers write every month, belongs in the CPI market basket with a weight of 7.6% because people actually pay it.

But the fictitious rent numbers “imputed” for the 2/3 of households who own the homes they live in do not belong in the index for reasons I have outlined before. Together, these figures give “Rent of shelter” a massive weight of 25.6% + 7.6%% = 33.2% in the overall CPI index, which distorts the numbers the Fed uses to make policy decisions. Including OER in the index magnifies the impact of rent on CPI figures, biasing them upwards, the proximate cause of the premature Fed tightening.

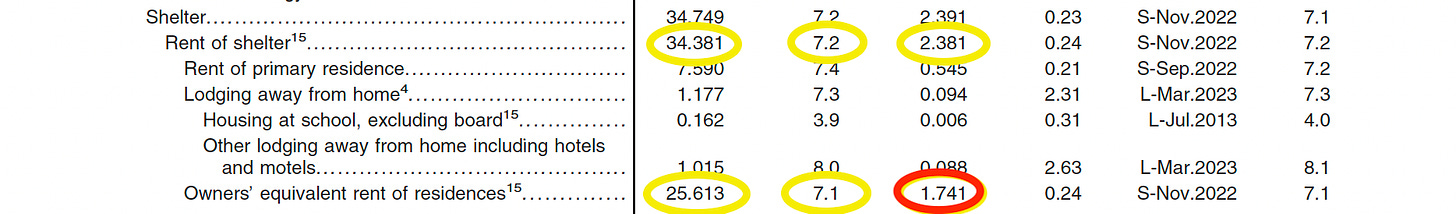

There is a caveat to this logic that means we should be careful how we think about even the legitimate 7.6% rent component. Roughly half of rentals are made with annual agreements, where the rent is only changed once each year. That makes monthly rent data slow to reflect changes in market conditions, because we can only “see” an increase in rent as contracts are renewed over the following 12 months. This gives both rent and OER data in the CPI report momentum (they are autocorrelated). Because of this feature, you can see changes in the official rent numbers coming months ahead of time by looking at actual market rents on new leases, like those collected by Zillow and others. That’s why I have been writing for months that even reported CPI inflation will be on a downward path over the next year.

According to Zillow data on asking rents, rent inflation peaked at 16% in February, 2022 and has fallen every month since then to just 3.2% today, as you can see in the chart above. Using the 7.4% Rent of primary residence figure in the CPI report to the Zillow 3.2% figure would reduce its contribution to the CPI by about half and further reduce my estimate of Sept CPI inflation from 1.96% to 1.65%.

PCE Inflation Was Lower Too

The same logic holds using the PCE price index, the Fed’s favorite inflation measure. The September Personal Income and Outlays report tells us the PCE price index for increased 3.4% over its level a year ago. Housing makes up a somewhat smaller share (15%) of the PCE price index than it does in the CPI (34.4%). According to BEA data, the rent component of the PCE price index (76% of which is OER) increased by 8.3% in the year ending in September, which means that the non-rent component, which makes up 85% of the index, increased by just 2.5% per year—close enough to the Fed’s target for them to knock off scaring the bond market with higher-for-longer speeches.

Tangible Asset Inflation is What Matters

I will conclude this analysis by suggesting that you take my calculations with a grain of salt too. I hope I have made it clear that both the CPI and PCE indexes have a built-in design flaw that causes them to overstate today’s inflation rate. That should be enough to ask Chairman Powell to put down the mike and back slowly away from the podium.

What I haven’t done is explain why the CPI, the PCE, and all other price measures derived from the GDP accounts are the wrong measures of inflation in regard to interest rates. I have long maintained that real asset inflation, not GDP inflation, is what matters for interest rates. My reasons are simple:

All of economics boils down to one positive statement. People will engage in arbitrage when they see price differences between goods and services or return differences between assets.

Interest rates are determined by the arbitrage between the expected returns on holding bonds and the returns on holding other assets over the course of a year.

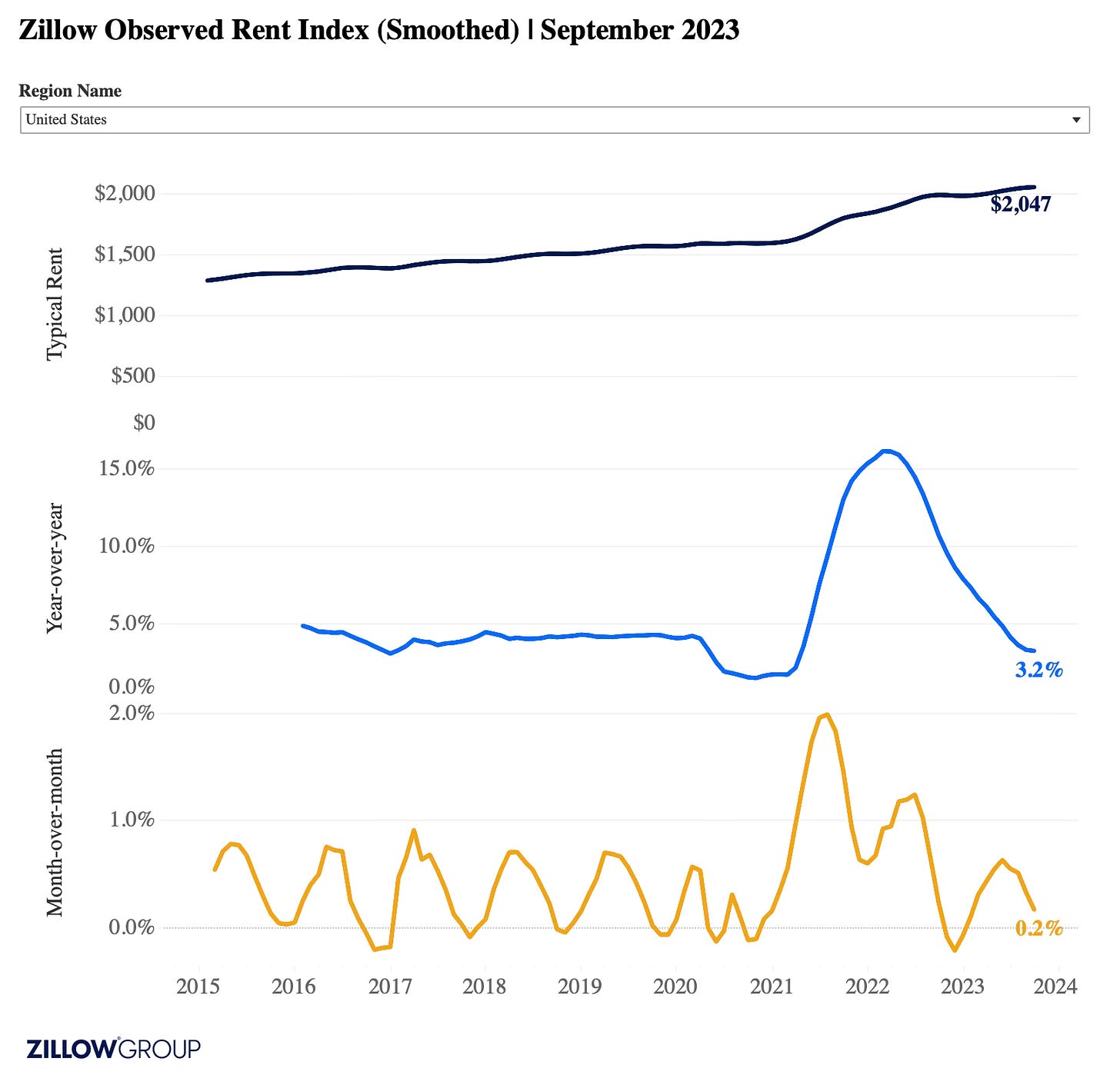

The most relevant “other asset” for households is the their homes, which account for 61% of their total assets. According to the Zillow Home Price Index, Sept. house price inflation, roughly the unlevered capital gains yield on owning a house, was -0.09 for the month and 2.1% over the previous year, down sharply from 2.45% MOM and 17.8% YOY in April 2022.

The CPI, PCE, and other flow-based inflation rates are irrelevant to this analysis. They cannot play the role of assets because their market baskets are dominated by services that fully depreciate over time, i.e., the return on holding both market baskets is always less than zero. (You can’t store haircuts and guitar lessons.)

As a corollary, real interest rates should be measured as the difference, or spread, between the expected returns on bonds and on other assets, in particular the return on holding the public’s massive stock of real assets, not as the difference between bond yields and the CPI inflation rate. On that basis, because house price inflation today is so low (and I would argue likely to be negative next year), real rates today are quite high by historical standards.

And yes, this implies that the so-called “natural rate”, or r*, that drives the Fed’s macro models makes no sense at all.

All of which boils down to Michael Kalecki’s famous statement to Joan Robinson that economics is the science of confusing stocks and flows. I have spent most of my professional life working to correct this problem. If you’d like to see my writings on the topic you can find them under the “My-croeconomics” tab at the top of my substack home page.

Implications for Investors

This is a tricky time to be an investor, but that’s our job so here we are.

The COVID pandemic has made it much more difficult to make investment decisions. I have referred to this as the Real Long COVID in previous writings. In particular,

A reading of history shows that plagues and pandemics scare people so much that we retreat into the supposed safety of our own tribes where we reject outsiders and opt for strongman leaders. As a result, pandemics are often followed by extended periods of conflict within and between nations that make extreme tail events more likely. Today’s headlines serve as examples.

Shutdowns, supply-chain interruptions, and extreme fiscal, monetary, and regulatory policies have undermined the dependability of standard data collection and processing procedures. That makes data unreliable for some time.

The biggest risk for an investor today is to think you know something that you don’t really know. That says stay humble, be careful, question every rule of thumb and every analysis, and hold too much cash.

We do know that the Fed has overreacted to inflation, that they have pushed rates too high, and that they don’t understand their mistakes. That means one of two things is likely to happen,

We could get lucky. The Fed could learn from their mistakes, avoid further rate increases, decide to end QT, and push rates lower in the new year. That would ease bank balance sheet problems and help support the CRE refinancing that needs to happen in 2024 and 2025.

We could get unlucky. The Fed could make another mistake and raise rates again in the next few months. That would increase pressure on the banks and trigger a credit crisis, making the CRE refinancing that much more difficult.

Either way, investors are well advised to stay liquid, keep leverage low, and keep too much cash on hand to take advantage of the deep-discount opportunities we are likely to see over the next two years.

Dr. John

I don’t want to close without mentioning the valuable work that other Substack authors are doing on this topic. Today I want to single out Barry Knapp at Ironsides Macroeconomics, Paul Allen Winghart at Surplusproductivity.com, Blake Millard at the Sandbox Daily and the author of Daily Chartbook. I suggest that you read them all.

Love this: All of which boils down to Michael Kalecki’s famous statement to Joan Robinson that economics is the science of confusing stocks and flows.

great piece, john. as you may or may not remember, i've harped on this concept of measured inflation is too high (and GDP greatly understates economic welfare) forever. my question is: do your correct comments and measures include the impacts of ignored and mismeasured product quality changes, or do they need to be added on still? thanks as always. best, swk