The Fed Story is Over

It's Time for Investors to Prepare for an Extended Period of Falling Rates

Summary: The Fed raised rates again for the 11th time in the past 16 months—I believe for the last time. Although I think raising rates was a mistake, it was a small one compared with the damage they have already done that will only accelerate the reversal to falling rates that I believe will happen later this year. It’s time for investors to stop worrying about the Fed and prepare for the shift to an extended period of falling rates. Today’s tight credit markets mean the cost of capital is far higher than posted rates today. We are fast approaching a time when patient investors with ample liquidity will be able to put money to work at extraordinary returns by ‘solving’ the liquidity issues of other investors.

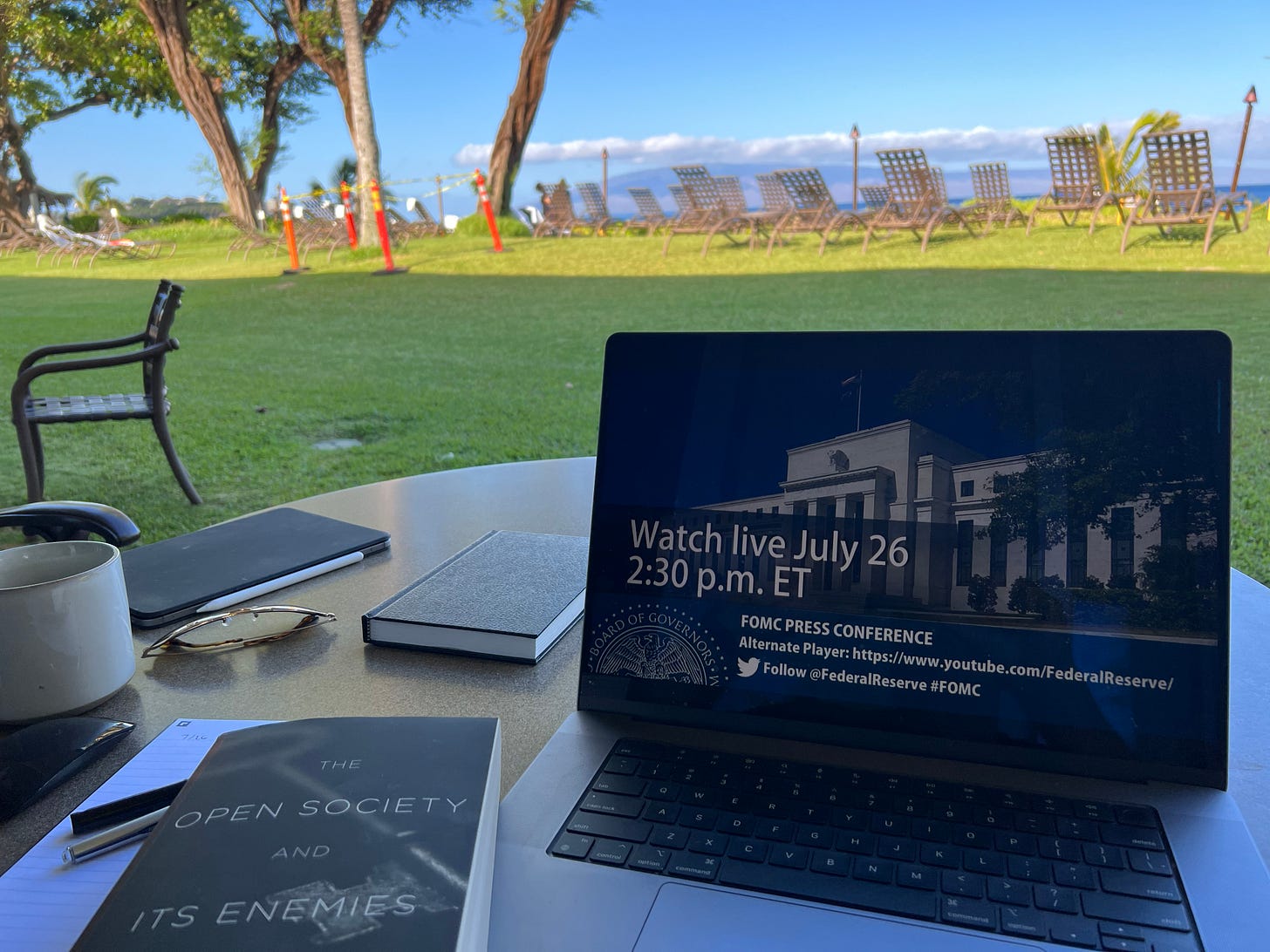

As you can see in the above photo, I have discovered the optimal vantage point from which to observe a Fed press conference—sitting on a lanai in Maui. The coffee is good; the temperature is perfect; and I can press [ESC] and switch to more serious matters, like fighting my way through Karl Popper’s (dense) classic “The Open Society and its Enemies”, when I get tired of hearing reporters ask Chairman Powell the same question over and over again (see below.)

PRESS CONFERENCE SUMMARY

RANDOM REPORTER: So, you're, like, not going to tell us what you are going to do next?

CHAIRMAN POWELL: That's right, I'm, like, not going to tell you what we are going to do next. Next!

[ REPEAT 20 TIMES]

The Fed Made Another Mistake

The Fed raised the Fed funds target again this week to 5.5%, their 11th increase in the past 16 months, and told us they would continue to sell $65 billion of Treasuries and $35 billion of mortgage-backed securities every month until they change their minds. Everybody knew this would be the FOMC meeting result but stock prices fell anyway. You can read the press release here; you can read the transcript of Chairman Powell’s remarks here; and you can see a video of the press conference here.

Before moving on, I should say that Powell gives a good press conference. He is calm, he is articulate, he makes his points clear in very few words, and he has good command over both his arguments and recent data at the podium. Well done, Jay.

That doesn’t mean I agree with him. For reasons I have laid out in a recent post, I think the Fed has been misled by faulty data into raising rates too far, too fast. Corrected for the distortions caused by the inclusion of so-called Owners’ Equivalent Rent, inflation has been running near the Fed’s 2% target since May and will fall further over the next several months. The next move of interest rates from here will be down.

Real Interest Rates Are Much Higher Than Chairman Powell Thinks They Are

One disagreement I have with Powell concerns real interest rates. Chairman Powell was correct when he said “the real Fed funds rate well exceeds most estimates of the neutral rate.” But the real rate, in my opinion, is much, much higher than he thinks it is and likely to increase further in the months ahead.

Here’s what I mean. The real interest rate Powell is referring to is calculated by subtracting an inflation rate—the CPI or PCE for the Fed—from an interest rate. If the Fed funds rate is now 5.5% and the inflation rate is either 3.0% (June CPI) or 3.8% (May PCE), that would make the real funds rate either 2.5% or 1.7%.

But, as I tell my students, that is the wrong way to calculate a real interest rate, a relic of the economics profession’s myopic fixation on the GDP accounts and neglect of the economy’s balance sheet.

There is only one real law in all of economics—the law of arbitrage. In flow markets for goods and services, arbitrage boils down to buy low, sell high. People confronted with two different prices for the same good or service at the same moment in time will buy the one with the low price and sell the one with the high price which will tend to drive the prices together.

In asset markets, however, arbitrage means something different. People confronted with the choice between two assets will choose to own the one with the higher expected return over a defined holding period. In this context, we could define a real interest rate as the difference between the return on, say, a one year Treasury bill and that of a real asset such as a house, both held for one year. If I own a one-year Treasury for the next year I am going to earn a return of 5.4%. If I buy a house at today’s listed prices and hold it for a year my best guess is that I am going to earn a negative return—somewhere in the minus-10% to minus-15% range—because prices are likely to fall. That would make my real rate calculation turn out to be somewhere between 5.4% - (-10%) = 15.4% and 5.4% - (-15%) = 20.4%, high enough to do serious damage to both asset prices and balance sheets over the next year.

The reason the standard calculation makes no sense it that it is trying to compare the returns on an asset, like a Treasury Bill, and a basket of goods and services taken from the GDP accounts, like the CPI or PCE inflation rate. That’s because 61.5% of the CPI basket is made up of services, like haircuts and guitar lessons, that you can’t hold for one year because their physical depreciation rate is 100% per year. Nondurables, like milk, eggs, bananas, and paper towels, account for another 25.9% of the CPI basket—they don’t store so well (100% depreciation) over a year either. That only leaves 12.6% of the CPI market basket for durable goods—things that will still be here a year from now—to do the heavy lifting in the arbitrage story, although I don’t normally think of Furniture and Bedding (1.15%), Major Appliances (.102%), or Tools, Hardware and Outdoor Equipment (1.07%) as important sources of either dividends or capital gains.

As a caveat, I have given you all of these arguments in shorthand form. In practice, we have to think of all of the things that matter—taxes, liquidity, risk, storage and maintenance costs, etc.—when we compare yields on assets. But you get the idea. Real rates need to be calculated using assets, not short-lived goods and services. Standard calculations have little meaning. I have written about this topic before here.

My point is that real interest rates, calculated properly, are much higher than Chairman Powell thinks they are. And that’s going to put continued pressure on real asset prices until the Fed changes course.

Credit Crisis Risk Remains Until Rates Start Down

If all this goes the way I am suggesting, the recession that forecasters keep postponing will not happen and rates will begin a gradual descent, good news for stock and bond prices. If I’m wrong, it will be because one of two important banking system issues erupts to transform the credit market tightening that Powell talked into a frozen credit market.

In spite of Powell’s claims that “things have settled down” and the banking system is “strong and resilient,” regional bank balance sheets are still hiding behind accounting gimmicks to hold a ton of underwater Treasuries and Mortgage-backed securities. And they own a bucket full of loans on see-through office buildings that will need to be refinanced in the next two years. With luck, these risks should recede once the Fed has begun to lower the Fed funds rate. Until then, I will be preserving liquidity and holding my breath.

Great piece.

I'm curious, what about effectiveness lags? I suppose I'm of the opinion that inflation YoY is pernicious to inelastic goods. I'm just wondering if they're looking at everything you're saying they should be weighing, but there are hidden factors we just don't know about. I suppose mistakes, like externalities, really only emerge after they've become real versus just crying crocodile tears.

The Fed is probably not giving people not much to hang their hat on aside from rising rates, because to telegraph something more could put a dent in their inflation-slaying campaign, because it'll create more volatility and uncertainty on top of what's already baked into the consciousness of investors of all types.

if by over You mean they’ve spent their powder I would agree 100 percent ..

but as You suggested they haven’t used the correct measure ..

not sure how many iterations of zirp, zap and zip we’ve endured since 2008 but there are too many to count each resulting in expanding the money supply..

thank You Kindly

John for sharing Your thoughts