Treasury Bone Connected to the Fed Bone

If you liked QE, You'll Love What Yellen is doing at the Treasury

Summary: My head is killing me! As I argue below, the Fed and Treasury (Fedury?) are holding hands printing their brains out which pushes prices up. At the same time we are all waiting to hear about the next Hwangker with a margin call pushing prices down. In the near term I think the Fedury side wins the tug of war. But the uncertainty is so great that I’m not going to hold a leveraged position in anything today.

After raising six kids, I knew that the knee bone was connected with the thigh bone but nobody ever told me about the Fed and the Treasury. Now that we have two Fed Chair-people—Powell at the Fed and Yellen at the Treasury—we need to pay more attention. Recent moves by the Treasury are fire-hosing money into bank accounts. That’s one reason to not go to sleep short the market just yet.

The Treasury keeps its petty cash—the money that piles up between hovering up our money and giving it to somebody else—in a cash account at the Federal Reserve Bank of New York. Of course, being Big Brother, their petty cash isn’t so petty. As you can see in the chart above, the Treasury usually keeps about $400 billion on hand. All that changed last March when the bond market seized up, the Fed turned on the QE spigot, and Congress passed the CARES Act and started sending out checks. The Treasury borrowed enough to roughly quadruple of Treasury cash balances from $400B to $1.8T over the course of 2020.

About a month ago, the Treasury changed its tune when they announced they would cut the cash balance in half by April 1 and to $350B by the end of June. You can read a Reuters piece with the details here. As the chart shows, the blue line went limp last quarter which means they are actually doing what they said they would do with more to come between now and June. That’s a drop of roughly $1.5T in six months. What does it mean?

I’ll give you the punch line before I give you the why. The money ends up increasing somebody’s bank account, which increases the demand for all sorts of assets, including mutual funds and ETFs as you can see in the spike with the little circle on top in the chart above. You don’t want to be short the stock market when that is going on.

Now I’ll give you the why. There are two kinds of money, cold and hot. Treasury cash balances are cold money; they sit in an account at the New York Fed and have no influence on anybody’s spending decisions. Your and my cash balances are hot money; we can do anything with it we want.

When the Treasury is running up its cash balances, like they did during 2020, they are collecting more money out of people’s bank accounts—some from people paying taxes, some from people buying Treasury bills—than they are sending out to other people, which drains liquidity. Think of it as project Anti-QE. That was most of 2020.

When the Treasury is running down its cash balances, as they are doing now, they are putting more money in people’s bank accounts than they are taking out. Some of that is sending stimulus checks to people while not collecting it back in taxes. Some of it is refraining from borrowing (smaller Treasury auctions) enough to make up the difference between cash inflows and outflows. Either way, the money ends up as increases in people’s bank balances and matching increases in bank reserves. Think of it as QE-2 (not the boat).

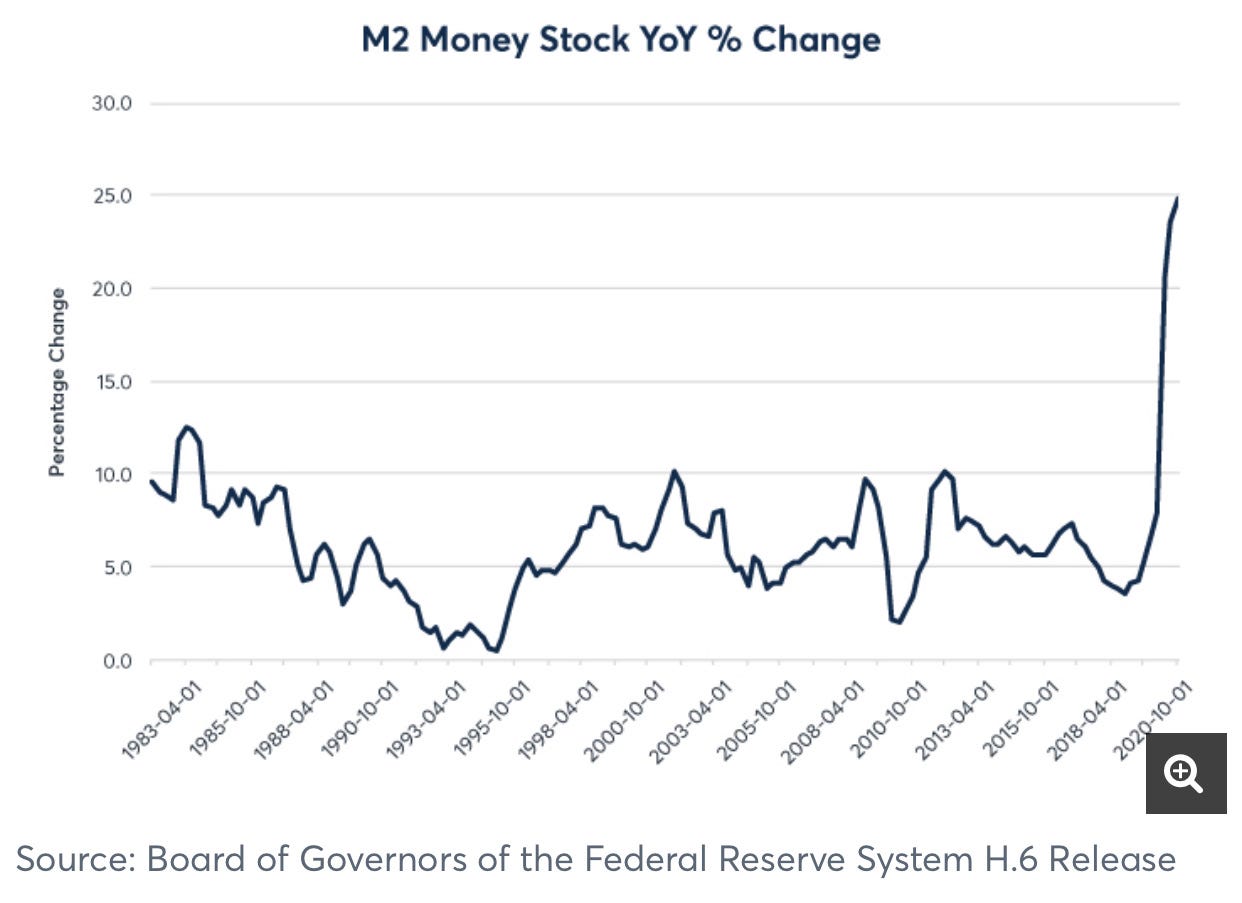

What about the Fed? They have been busy too, buying more than the $120B of bonds per month they announced as their minimum QE target. All that money goes into bank accounts and bank reserves too, which is why the M2 measure of the stock of money grew more than 25% last year (see the chart above).

The point I am making here is that the $1.5T is huge, roughly a whole year worth of the Fed QE program. In fairness, I should also mention that, as of yesterday, the Fed has thrown water on some of those extra reserves by allowing the SLR program, which stands for “Supplementary Leverage Ratio” to expire (you can read details here). Basically, the SLR program was a hall pass that excused the banks from holding additional 5% equity reserves to back the big increases in deposits they were enjoying.

You can think of this hall pass as absorbing about $600B of the$1.5T firehose money I have been writing about. That still leaves $900B going into bank accounts, a tidy sum. And we haven’t even talked about the $1400 checks in the new stimulus program or what the new infrastructure will do.

Bottom line is that every number you know is going to go up for a while including output, employment, income, profits prices and bond yields. We got a taste of that in today’s manufacturing purchasing managers report with jumps in both activity and input prices.

Having two Fed Chair-people at the same time, both doing huge QE programs, makes me not want to go to bed at night holding a short position in anything other than the 30 year Treasury bond as long as the Treasury is draining cash balances. All these numbers are so big that I would also expect markets to be extremely volatile during this period. Hold on folks.

Dr. John

A wild ride, indeed. Akin to WWII + GFC stimulus and policy. - Angela V.