Lumber Prices and Home Depot

If you're wondering why the streets are still empty, it's because everybody is at Home Depot buying stuff to fix their house.

Summary

Home Depot reported big numbers this morning.

One-third of increased ticket size due to higher lumber, materials prices.

Higher home prices due to COVID stimulus drove lumber prices.

As long as stimulus lasts, people will continue to shop.

Look for more big sales and earnings numbers for HD and LOW next quarter.

The stock fell 1% today. I am not a seller.

Half a billion customer transactions can’t be wrong

In case you’re wondering where all those stimulus checks went, Home Depot (HD) reported this morning 447.2 million customer transactions last quarter. Earnings were +86% year over year. Same-store sales were +31% overall, but +50% for transactions over $1000. More than one-third of the increase in ticket size was due to rising commodity prices. Lumber prices alone were up 370% from year ago levels. (FYI: I own shares of Home Depot and Lowes.)

Note to the FOMC: Good that this thing is transitory because it’s transitorily killing me.

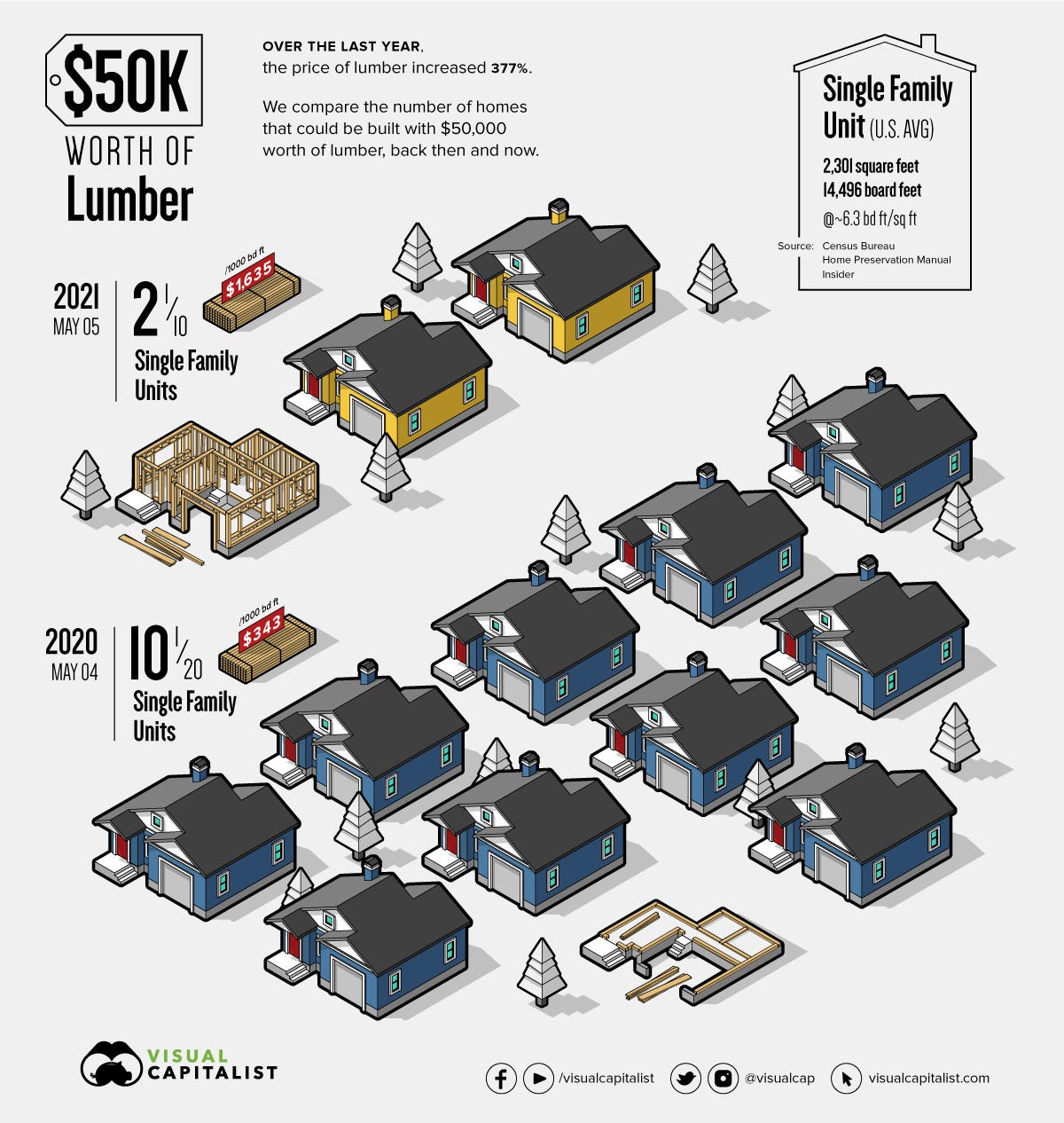

Ran across couple of interesting charts today that do a good job translating the lumber price number to real life. As you can see in the VisualCapitalist graphic above, the same number of dollars it took to buy the lumber to build 10 houses a year ago will only build 2 houses today. According to the NAHB, the average cost of building a new house has increased by $36,000 in the past year.

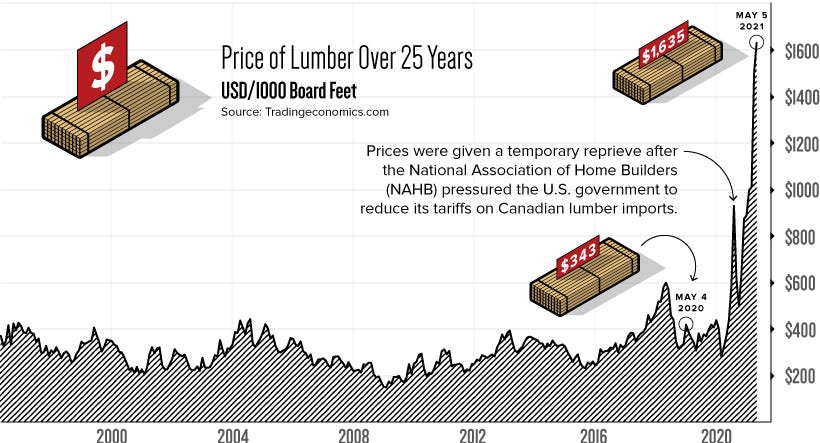

The chart above from TradingEconomics shows the spike in lumber prices compared with historical prices. As you can see, the price per 1000 board feet has now risen above the size of the average stimulus check—that’s no coincidence. There are many reasons why lumber prices jumped, but the main reason is the 15% increase in home prices since we all first heard the word COVID, the Fed turned on the firehose of money, and government stimulus programs started raining checks on us. (It also helped that the US charges a tariff of 9% on Canadian lumber imports but that’s another story.)

I think the stimulus-driven spending spree is going to continue for some time and that we will see more big numbers from home improvement companies so I have no plans to sell my HD and LOW shares soon.

In my next post I will write bout how I think about the relationship between the price of an asset (home prices) and the price of a good (lumber prices.) Hint: The prices of big things often determine the prices of little things. Size matters.

As always, I am interested in your thoughts.

I guess it's time for modular and 3-D printed homes to shine?

Supply and demand, supply and demand: knowing that demand is waaaaay up due to low interest rates, is supply being artificially limited due to collusion or are we facing timber shortages? I think the answer is that there is no artificial limit (anti-trust issues) but rather that the lumber companies are motivated to avoid a swine-cycle where strong capex ends up generating excess capacity that bites them when this one-off stimulus and artificially low interest rate environment stops generating the demand (or do the powers-that-be actually think that people will build a second, third and fourth home just to keep the economy going? OK, that might be a rhetorical question).

After all, construction material companies are well known as low-margin, cyclical businesses with inventory & price issues for volatile commodities. Give them the opportunity to make decent margins, anyone recommending capex to add capacity isn't thinking things through. Hence the bottlenecks will continue as no real incentives to capex your way out of a bottleneck exists, if anything there's a strong incentive not to capex but finally turn your EBITDA margins into double-digit returns instead of the usual single-digit realm (not HD or LOW, that's retail, I'm talking about their suppliers).